oregon workers benefit fund tax rate

The Workers Benefit Fund WBF assessment funds return-to-work programs provides increased benefits over time for workers who are permanently and totally disabled and gives benefits to. Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year.

Workers Comp Settlement Chart Average Payout Expectations

For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years.

. The Workers Benefit Fund Program Insurer employer and worker assessments fund the Oregon workers compensation administration and programs. The rate was increased by 08 percentage points in 2022 and 06 percentage points for 2020 and 2021. The program will feature a fund that starting in September 2023 will pay benefits to Oregon workers who need to take time off to care for a sick family member or after a birth.

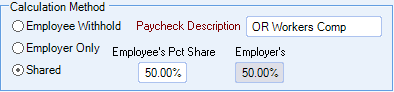

Go online at httpswww. Youll need to create a Payroll Deduction for the employee portion and an Expense for the employers portion. Workers Benefit Fund Payroll.

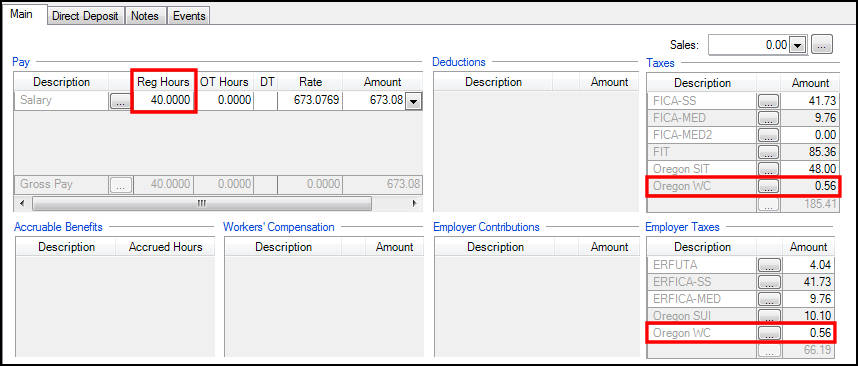

Self-insured employer and employer group premium. The Oregon Workers Benefit Fund WBF assessment is a payroll tax calculated on the number of hours worked by all paid workers. 40 hours 0014 056.

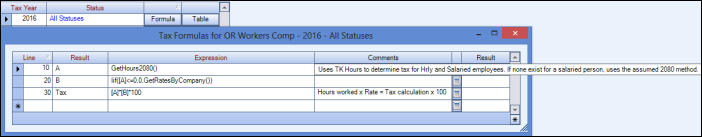

What is the Oregon WBF tax rate. Prescribe the rate of the Workers Benefit Fund assessment under. Enter the tax formula and table rate information.

This assessment is calculated based on employees per hour worked. You are responsible for any necessary. 3 Workers Benefit Fund WBF Assessment Important information The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

If you are an Oregon employer and carry workers compensation insurance you must pay a payroll tax called the Workers Benefit Fund WBF Assessment for each employee covered under. Remains at 98 percent in 2023 Self-insured employers and public-sector self-insured employer groups pay 99 percent Private-sector self-insured employer groups pay 103 percent Covers. Oregon Workers Benefit Fund WBF assessment Note.

Workers Benefit Fund Assessment Oregon Administrative Rules Chapter 436 Division 070 Effective Jan. What is the 2022 tax rate. Enter the tax formula and table rate information.

The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged from 2021. Tax rate increased more than 10 percentage point and not more than 15 percentage points will be eligible for 50 percent of their deferrable UI taxes forgiven Tax rate increased more than 15. For 2022 the rate is 22 cents per hour.

Open the Payroll Deductions list Lists Payroll Categories. You are responsible for any necessary. The workers benefit fund assessment rate will be 22 cents per hour in 2023 Employers are required to pay at least 11 cents per hour Oregon Workers Compensation.

Example of how the WBF assessment is calculated This example uses the 2017-2018 WBF rate of 28 cents. Oregon workers are subject to Workers Benefit Fund WBF assessment tax. The 2022 payroll tax schedule is a.

For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. The Workers Benefit Fund is one of two.

2022 Federal Payroll Tax Rates Abacus Payroll

Carve Outs In Workers Compensation An Analysis Of Experience In The California Construction Industry

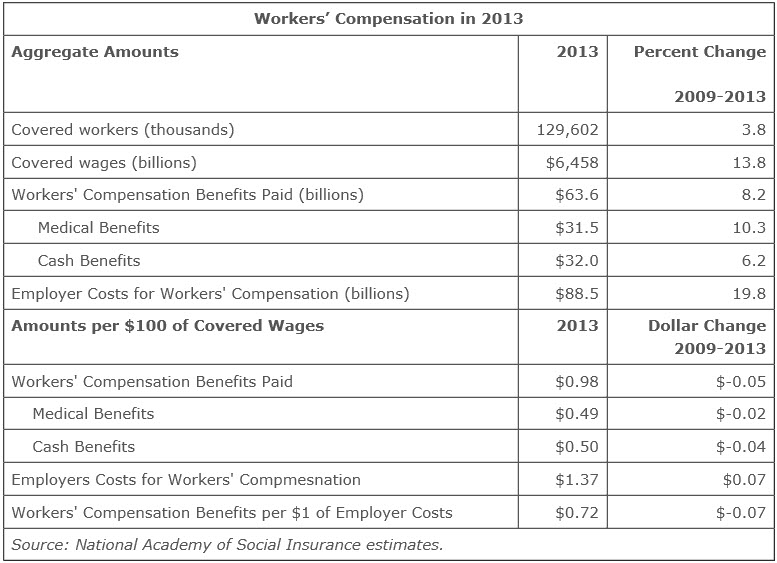

Workers Compensation Benefits For Injured Workers Continue To Decline While Employer Costs Rise Recent Cases News Trends Developments Workers Compensation Lexisnexis Legal Newsroom

Oregon Workers Compensation Assessment Rate Unchanged For 2022

Department Of Consumer And Business Services Oregon Workers Compensation Costs Oregon Workers Compensation Costs State Of Oregon

Oregon Workers Benefit Fund Payroll Tax

Benefits Oregon Business Industry

Workers Compensation Rates In Oregon

Workers Compensation Insurance Policies Travelers Insurance

How Are My Workers Compensation Benefits Calculated Kbg Injury Law

Workers Compensation State By State Information

Workers Compensation Rates Explained 2020 Workers Comp Rates

Oregon Workers Benefit Fund Wbf Assessment

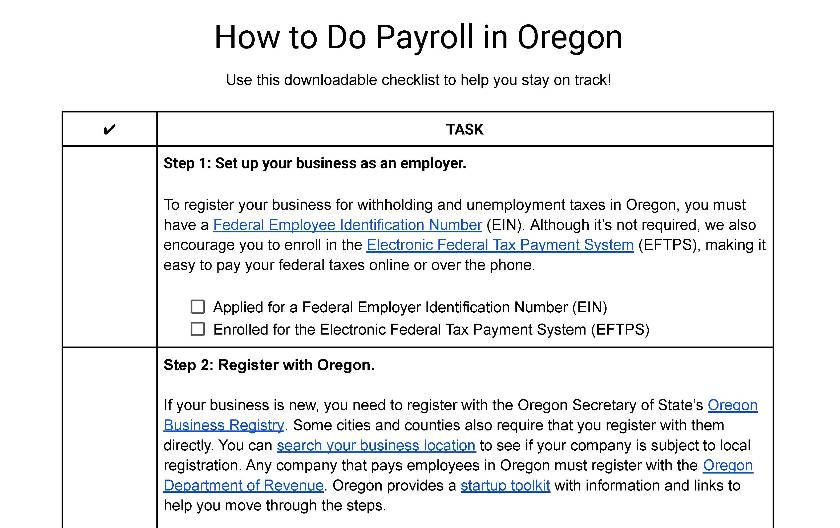

How To Do Payroll In Oregon What Employers Need To Know

Workers Compensation Death Benefits By State Interactive Map

Carve Outs In Workers Compensation An Analysis Of Experience In The California Construction Industry